There are a few considerations to keep in mind when investing in Dogecoin. While the coin has seen some incredible peaks and troughs, Doge has never been worth more than a dollar. There’s an unlimited supply of Dogecoin, which means that the value relies on buyers constantly buying new Doge that enters circulation.

There may be higher security risks with Doge because it hasn’t had the same level of code security or scrutiny that many other currencies have had. That goes back to the fact that it traditionally wasn’t treated as a serious cryptocurrency.

Another consideration is that holdings are becoming increasingly concentrated (much like with other crypto assets) — in fact, nine wallets hold more than 40% of all Dogecoin, one of which holds close to 30%. That means that those investors have a heavy hand on how the price could potentially change — they could cash out and the price of Doge would fall, or they could use their large position to manipulate the price of Doge.

The entities with large holdings that could potentially move the markets are often called “whales.”

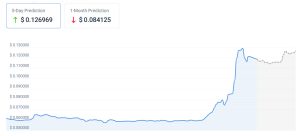

For a currency that started at $0.00, its lowest price, Doge has had a remarkable journey. Its most exciting phases include the tipping service DogeTipBot and Musk’s public support of the currency, which caused its peak price of $0.74 and a 9,884% increase within five months in 2021.

Investing in Doge comes with its risks, however, and the future of Dogecoin remains unpredictable and volatile. Still, if you’re ready to join the fun and start trading crypto, it’s easy when you set up an Active Invest account with SoFi Invest. From there you can open a crypto trading account in minutes, and trade dozens of different crypto 24/7. SoFi does not offer staking or a crypto wallet.