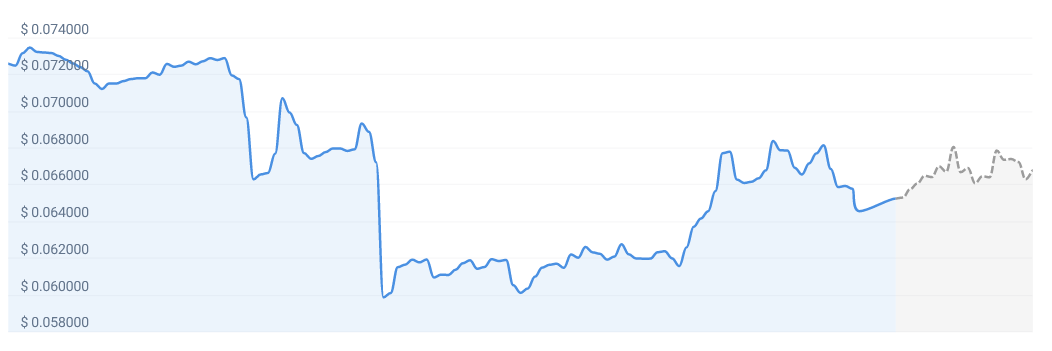

Dogecoin, originally created as a light-hearted and fun alternative to Bitcoin, has emerged from its meme roots to become a serious player in the world of cryptocurrencies. Our current market forecast suggests a rise of approximately 1.92%, which could push Dogecoin’s value to $0.066829 by July 2, 2023. This projection is a result of meticulous scrutiny of recent trading volumes, price trends, and overall market momentum.

An essential factor to consider while studying a cryptocurrency is the sentiment around it. According to our technical indicators, the current sentiment for Dogecoin leans towards the bearish side. This sentiment is formed by collating data from a variety of market indicators, including recent trading volumes and price movements.

Interestingly, the Fear & Greed Index, a widely utilized metric for gauging the market’s emotional state, sits at 59 for Dogecoin, which falls into the ‘Greed’ category. This index is a combination of data from various market indicators, including volatility, social media sentiment, surveys, and market momentum. A score above 50 points towards a bullish sentiment, suggesting that despite the prevailing bearish sentiment, a considerable section of investors remains optimistic about Dogecoin’s potential.

Looking back at Dogecoin’s recent performance, it has recorded 50% green days over the past month, indicating that on 15 out of the past 30 days, Dogecoin’s closing price was higher than its opening price. This statistic demonstrates a level of resilience amidst the inherent volatility of the crypto market.

That said, Dogecoin has experienced notable price volatility of 6.49% over the past 30 days. While such volatility can potentially dissuade certain risk-averse investors, it may also provide opportunities for those with a higher risk tolerance. Experienced traders, for instance, could leverage this volatility for short-term profits, while long-term believers in Dogecoin might view these price fluctuations as opportunities to accumulate more at a lower cost.

However, our current Dogecoin forecast advises that this may not be the optimal time to invest in Dogecoin, primarily due to the existing bearish sentiment. This advice is but a piece of the investment puzzle and should not replace personalized financial advice. Investing in cryptocurrencies, including Dogecoin, involves inherent risks, and it is crucial for prospective investors to conduct thorough research and due diligence before entering the market.

In conclusion, Dogecoin presents a unique case in the realm of cryptocurrencies. Despite a prevailing bearish sentiment, the predicted modest price increase and the Fear & Greed Index’s bullish stance reveal a complex and dynamic market environment. While the upcoming period might not be the best time for buying Dogecoin, the volatile nature of the crypto market means that circumstances could change rapidly.

As we continue to monitor the evolution of Dogecoin and other digital assets, our commitment to providing readers with data-driven, insightful analysis remains unwavering. The world of cryptocurrencies is both exciting and complex, and our goal is to help you navigate it with greater understanding, whether you are a seasoned investor or a newcomer to the world of digital currencies.